They may be you and your spouse significant other a brother or sister or any two people who may have an interest in pooling their assets for estate planning purposes.

Joint revocable living trust florida.

Upon your death or when the beneficiary reaches a certain age.

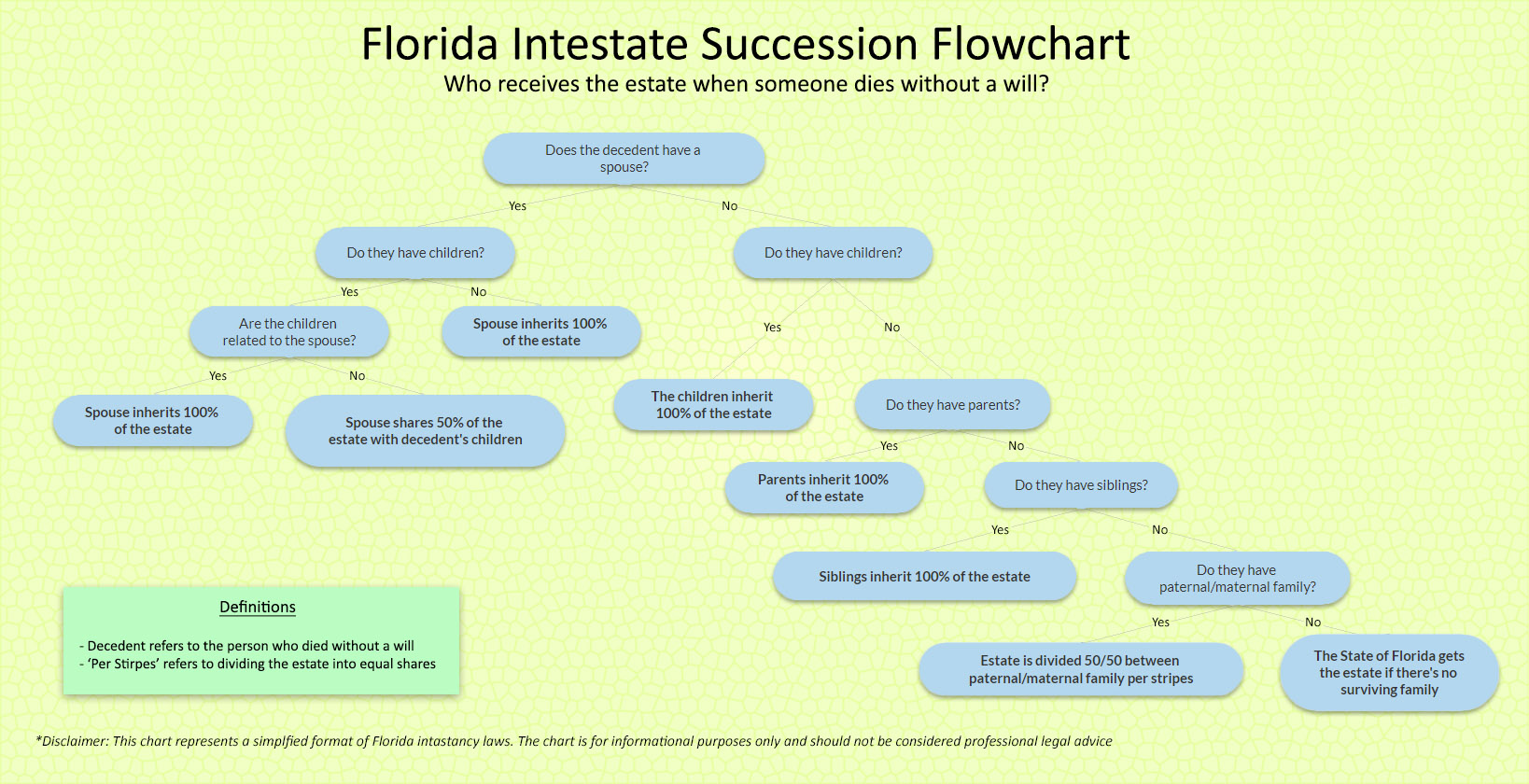

The revocable or living trust is often promoted as a means of avoiding probate and saving taxes at death and is governed by chapter 736 florida statutes.

While many attorneys swear by one trust over the other there are many factors such as the state in which the couple resides the total of their marital estate and the couple s relationship itself that contribute to the decision of which trust is.

A joint living trust can however result in significant gift and estate tax problems in certain estates for which tax planning is required.

The revocable or living trust is often promoted as a means of avoiding probate and saving taxes at death.

The use of a joint revocable living trust as the primary estate planning instrument can be appropriate for certain married couples whose assets are uncomplicated and whose combined estates are not subject to the estate tax.

An ab trust is a special type of trust that will protect the beneficiaries when one spouse dies and the trust is still revocable.

The revocable trust has certain advantages over a traditional will but there are many factors to consider before you decide if a revocable trust is best suited to your overall estate.

Joint trusts probably shouldn t be used between couples in a common law marriage or alternative lifestyle couples.

If you live in florida this guide will tell you how to set up up a living trust and also provide some relevant information to help you decide if a living trust is the right option for you.

It is flexible because you can specify when you want the property or assets distributed i e.

The option of creating the marital trust at the death of the first.

The joint revocable living trust jrt is a special type of revocable living trust that is created by two people grantors.

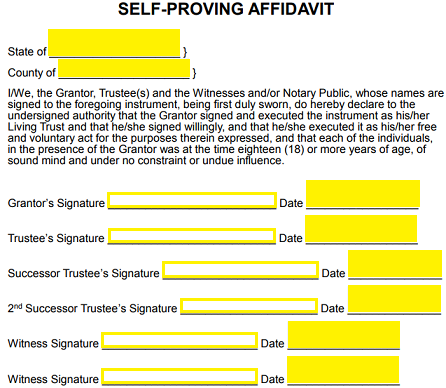

The florida revocable living trust is a legal form created by a person a grantor into which assets are placed with instructions on who will benefit from them the grantor appoints a trustee to manage the trust in the event they become mentally incapacitated.

Download this florida revocable living trust form in order to set aside certain assets and property of your choosing in a separate flexible entity for the benefit of your chosen beneficiaries.

The revocable trust has certain advantages over a traditional will but there are many factors to consider before you decide if a revocable trust is best suited to your overall estate plan.

So technically the one trust document creates a joint revocable living trust and then a separate trust for the husband and a separate trust for the wife.

A living trust is one way to plan your legacy and estate and to make things a bit easier for your family once you ve died.

The grantor may appoint themselves trustee which is an advantage over the irrevocable living trust.